Textile Industry in India: Heralding a New Era

India is replete with natural resources like cotton, Jute and silk. Indian textile Industry is also the largest employer (after agriculture) of workers directly and indirectly.

The industry plays a significant role by contributing 4% of GDP and 12% to the countrys exports. Indian textile Industry is completely self reliant in the entire value-chain from cotton crop to Home Textiles & Hi-fashion garment making.

World Trade in Textile & Clothing

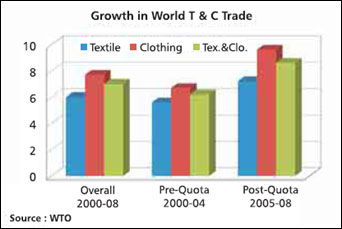

World Trade in Textile 8, Clothing (T & C) increased from US$ 356 billion in 2000 to a level of US$ 612 billion in 2008, at a CAGR of 7%. In 2008, T&C Trade has slowed down to 5% as compared to a healthy growth of 10% in 2007.

Assuming a conservative growth rate of 5%, world trade in T&C is expected to reach a level of US$ 700 billion by 2012. World Trade in the first four years of post quota period recorded around 8% growth rate as compared to around 6% growth for the period 2000-2004.

Export Scenario

Export of T & C

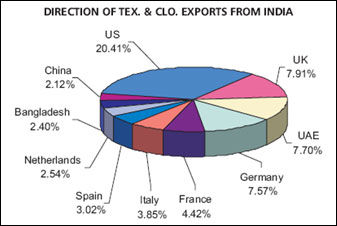

India exported US$ 21.6 Billion Textiles & Clothing in the year 200809. The top ten markets were USA, UK, UAE, Germany, France, Italy, Spain, Netherlands, Bangladesh and China.

Export of Cotton Textiles

Within Textiles Cotton Textiles account for almost 50% of exports (USD 5.08 Bn) indicating the importance of the Cotton Textile sector in the Indian Textile industry.

Global trade in cotton textiles recorded a growth of around 4% in 2008, which is higher than the export growth of textiles of all fibres (3.70%), indicating a higher demand for cotton-based textile products.

Within this basket the, export of cotton fabrics and cotton made-ups recorded growth rates of 3.52% and 8.35% respectively in the year 2008.

Higher growth in exports of Made-ups as compared to Fabrics and Yarn indicates the growing demand for finished products.

Growth in exports of Made-ups as compared to Fabrics and Yarn indicates the growing demand for finished products.

Global Competitiveness and India's Position

With the dismantling of quotas the global forces have been redefining the sourcing base for textiles.

The main factors guiding competitiveness are cost, quality and timely deliveries. On its part, the Indian textile Industry has been adopting itself to the changing dynamics of international trade with varying degrees of success.

This is largely due to the uneven development of the sector which continues to be fragmented except for the Spinning sector. Organized sector contributes to more than 80% of spinning but less than 5% of weaving. Many Units in the organized sector are actually conglomerates of medium sized mills.

Over the past couple of decades, the Industry; has achieved significant progress in addressing the challenges posed by technical obsolescence, raw material vagaries and lack of modernization, particularly in the spinning sector.

However, weaving and processing sector continue to be a weak link in the value chain, compared to our major competitors. Medium and small scale industries perform the majority of weaving and processing operations.

The level of weaving technology and capacity of knitting units to perform dyeing, processing and finishing is seen to be improving during the past few years but they still have a long way to go in order to catch up even with our neighboring countries.

The apparel sector has over 25,000 domestic manufacturers, 48,000 fabricators and around 4,000 manufacturers/exporters. Over 80% of these are small operations (less than 20 machines) and .are proprietorship or partnership firms cotton apparels constitute a major part of India's apparel exports The ratio of Cotton to MMF in India is 62:38 as against the reverse global average of 40:60

Trends in Globalization

The major trends shaping the globalization of world Textile & Apparel trade include:

- Growing integration of the value chain

- Efficiencies in the supply chain management system

- Greater focus on Brand Developrnent

- Widening of the product base

- Diversification of Markets

Growing integration of the value chain

There is a growing recognition amongst countries for integrating the value chain from "Farm to Fashion". This trend enables vendor management, assists in cutting cost and also ensures one-stop sourcing of products.

The Chinese have successfully implemented this concept in their Special Economic Zones. In India also efforts are being made to set up integrated textile parks & processing facilities in identified textile clusters. However the process needs to be accelerated so that each segment of the textile chain captures the value.

Efficiencies in the supply chain management system

Indian textile and clothing industry has one of the most complex, fragmented and long supply chain in the world right from raw material procurement to shipping & port handling facilities.

Serious efforts have been undertaken to reduce the average manufacturing and delivery lead time from fabric buying to shipment of apparels.

The time taken for procurement of raw materials and then exporting finished goods from India (i.e. from approval of design to delivery in warehouse) is seen as a serious handicap.

The process needs to be speeded up. In this connection, it won't be out of place to mention that amendment of 'Cabotage Regulations-Section 407 & 408 - of Merchant Shipping Act' allowing foreign flag vessels to carry domestic cargo in EXIM containers through coastal shipping from West Coast to East and South Coast would help in enhancing the efficiency in supply chain management of Textile manufacturers.

Greater focus on Brand Development

It is becoming quite clear that developing world-class brands in the International market is essential for attracting FDI in T & C sector. Right now, oddly a handful of brands from India are recognized in the international market. Considering the vigorous efforts being undertaken by our competing countries In promoting their Brands and also the growing retail format worldwide in response to changing consumer preferences. It is high time that Indian entrepreneurs invest in brand building with active involvement of private- public partnership.

A suitable financial assistance program should also be devised by the government in order to encourage exporters to invest in brand building in promising sectors like Home Textiles.

Widening of the product base

Analysis of trade data shows that the top 50 T&C products traded In the World account for almost 40% (US$ 247 Billion) Out of this; India appears amongst the Top 5 suppliers only in 14 products.

We need to undertake suitable measures to widen the base of products manufactured and exported from India so as to meet the requirements of the consumers, rather than competing amongst ourselves in a limited range of products.

Market Diversification

An important factor that needs to be considered is the need to diversify the market base so that relevant products are sold in relevant markets.

For example, in markets like Peru, Argentina, Colombia, Bangladesh, Turkey greater emphasis needs to be placed on export of cotton yarn considering their manufacturing base and presence in supply of garments.

Similarly, in markets Iike USA, EU (27), Australia there is a greater scope for selling finished products like Home Textiles. In countries like Sri Lanka, Vietnam considerable opportunities exist for export of fabrics. In view of India's presence in the entire value chain from Fibre to Fashions, there is a need to clearly workout a Product - Market matrix so that the promotion efforts are focused and synchronized.

Conclusion

As we enter the second decade of the new millennium, we need to break fresh ground in our efforts to reinvigorate this sector. It is envisaged that Rs.1753 Bn (Rs 1,75,300 Crore) investment would be required across the Textile and Clothing value chain in order to achieve a market size of USD 100 Bn (Approx Rs 4,80.000 crore) by the year 2015 (from the present level of USD 52 Billion (Rs 2,49,600 crore)

These investments will generate additional 70 lakh jobs directly in the industry. In order to attract this high order of Investment, the Industry must be perceived as an engine of economic growth In this connection we are extremely fortunate to have a young & visionary Minister of Textiles in Thiru. Dayanidhi Maran. In a short span of time several initiatives have been undertaken by the Ministry of Textiles. These initiatives have led the industry from a deep crisis to the path of growth and there are indications that we can look forward to a speedy recovery In the coming months.

In spite of the escalation in raw material prices, most segments of the textile chain have already started growing, as can be seen from the recent export figures. The industry is confident that in the corning months the tide will turn in favor of Indian exports and the sector would be well on its way to regain its past glory.

The author is Chairman, Texprocil